Delivering Balance

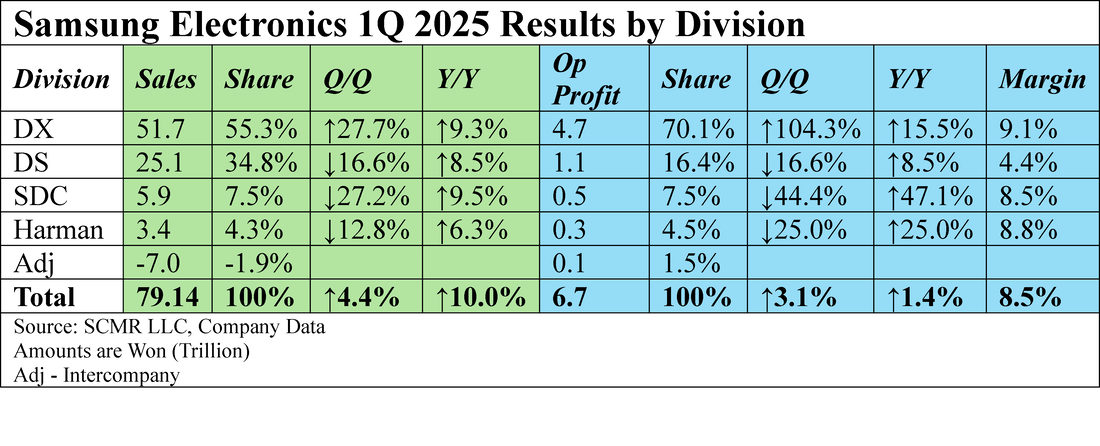

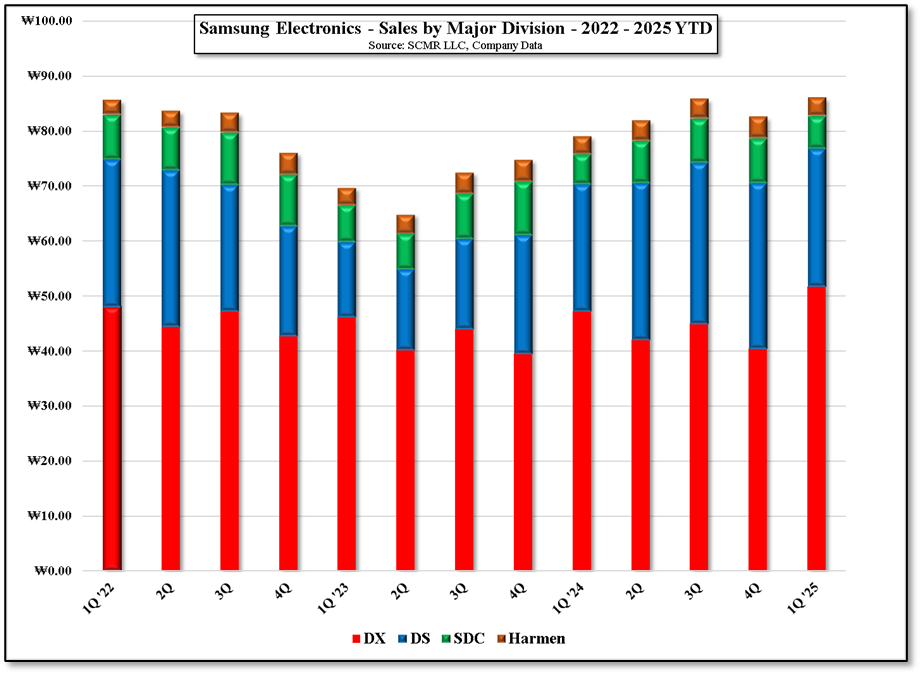

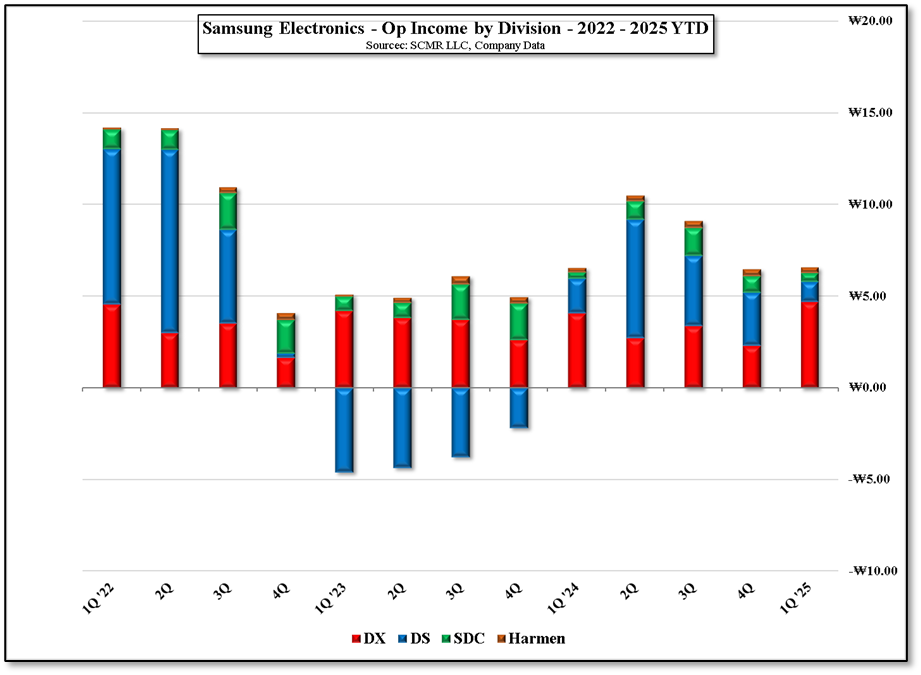

Last night Samsung Electronics (005930.KS) reported 1st quarter 2025 results of 79.14 trillion won ($55.25b US) in sales, ↑4.4% q/q and ↑10.0% y/y and 1.3% above consensus with this quarter being the best in the company’s history. Operating profit was 6.7 trillion won ($4.68b US), ↑3.1% q/q, ↑1.4% y/y, and ↑4.7% above consensus. In order to better understand the table below, which breaks down sales and operating profit by Samsung division, we note:

DX (Device Experience) includes – TV sets & Monitors, Appliances, Smartphones and tablets, Network Equipment, and Health Products

DS (Device Solutions) – Memory, Processors & Sensors, Logic, foundry

SDC (Samsung Display) – small panel OLED and large panel QD/OLED displays

Harman – Automotive & Consumer audio

As a number of Samsung’s major products have been exempted from US reciprocal trade tariffs, they have only moderate exposure to direct import costs, but as a component supplier, they were cautious about raw material costs impacting component prices and how that would follow through the supply chain. That said, without any hard US trade policy or realistic negotiations with major trading partners, and the prospects of another nuclear option in early July, they have little choice but to forge ahead as originally planned.

As seems to be the case with many larger CE companies who have the option, they are considering shifting production from countries that have onerous tariff requirements to less onerous ones, but seem to be in no rush to make those changes. We expect there will be lots of talk about how negotiations are progressing and how many deals have been agreed upon by July, but we also expect little confirmation, little detail, and even less about timelines for balancing trade. While the full impact of tariffs has yet to be felt by consumers, the peripheral impact, such as a weak equity market, has already put consumers on edge, something mentioned by Samsung a number of times on the call, we believe a big part of Samsung’s cautious stand on 2Q and the rest of the year.

Getting all Samsung divisions to operate effectively and profitably is a complex task and one drenched in global macroeconomics, but a bit less ‘unknown’ might be helpful in getting the planets to align. Below are our quick notes. Comments in red are our own.

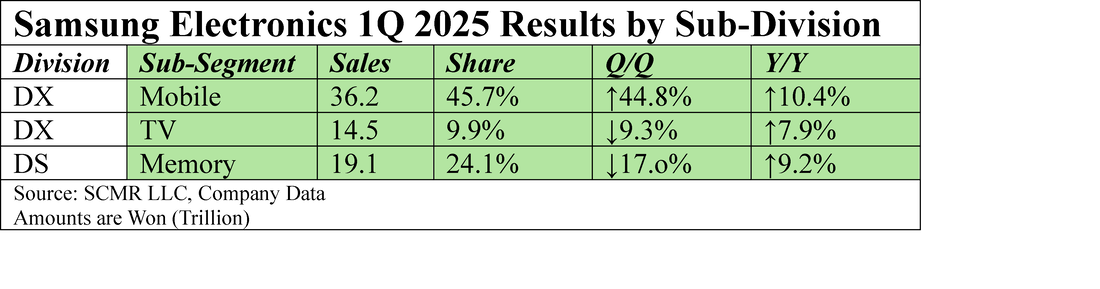

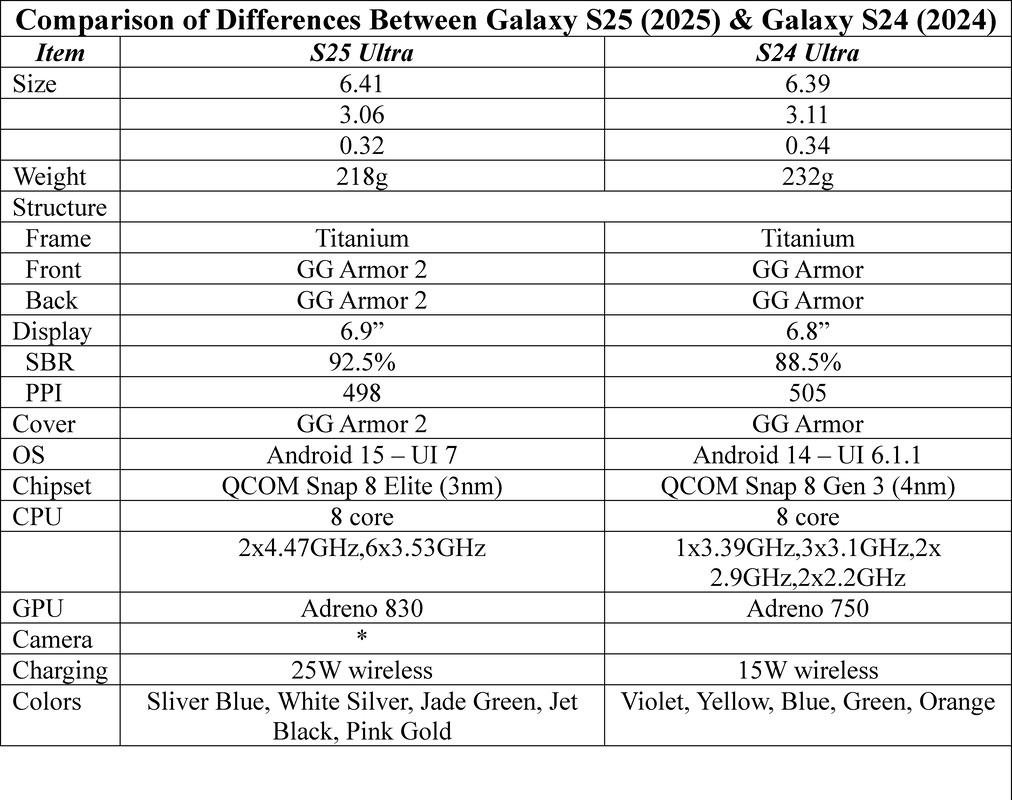

- DX strength came from flagship smartphone strength (Galaxy S25 series) and high-end appliances

- DS weakness came from demand deferrals from High Bandwidth memory customers

- Capex – 12t won with 0.5t won for display (down substantially), as the Gen 8.6 IT OLED fab is completed and 10.9t won for the DS division overall.

- Repurchased 3t won of common and preferred as part of 10t won 2025 program, which continues in 2Q.

- Ai Server demand remained strong

- Some PC/Mobile demand improvement (Small, possibly China driven)

- SSD demand weak

- Some data center projects delayed

- Bit growth higher than expected

- HBM export controls on AI chips and customers waiting for HBM3E release caused deferrals.

- Bit growth down ~10% but above expectations as perception that market has bottomed sets in. More, less downside pressure than upside pressure.

- AI Server demand to remain strong

- “Preemptive Purchasing” after tariff pause

- Memory for PC & Mobile inventory now normal because of China subsidy inclusion

- Overal,l expect some incremental demand but tariff remains a question

- Ai server demand to remain strong (Said a number of times)

- SSD to recover as deferred projects begin

- Incremental PC demand from Win10 end AI (Win10 replacement cycle theory seems dead – Ai better bet but still an unknown)

- Mobile demand improves due to AI

System LSI – General

- Weakness from delayed SoC adoption by major customer (Samsung)

- Strong demand for image sensors

- Expect image sensor volume to decline

- SoC increase to offset sensor volume decline

- Limited mobile momentum

- SoC steady

- Will add product (Automotive sensors)

Foundry – General

- Seasonal weakness for mature nodes

- Inventory adjustments due to China trade tensions (meaning order reductions)

- New advanced node starts in 2H

- Subdued demand

- Ramping production for US automotive products (Tariff issues?)

- Tariffs could have big impact

- 2nm GAA production starts in 2Q, but small

- Geopolitical Risk expected to increase

- Demand for PC & Mobile expected to weaken

- AI & HPC momentum still strong (advanced nodes)

Samsung Display – General

- Improvement in demand from major customers

- Favorable exchange rate

- But seasonally weak quarter

- Double digit monitor sales growth (QD/OLED share?)

- Mobile – Conservative view due to tariff situation

- Will launch new ultra-high refresh rate monitors (gaming)

- Increasing uncertainty due to trade issues

- Competition increasing

- Weak consumer sentiment

- Mobile driver is AI

- QD/OLED will expand monitor line w. lower-priced models (Good news – when?)

- Demand was down q/q but up slightly y/y w. premium and ultra-large TVs driving growth.

- Raised prices and lowered material costs but…

- Overall TV demand remained weak, and the cost of competition was high

- TV demand flat y/y

- Expanding AI TV (Will consumers care?)

- Demand for high-value products (Ultra-large and OLED) will remain

Q&A

Tariffs

- Semis, phones, tabs currently exempt

- Reviewing other products

- Potential to ‘manage’ global production

- Will cancel 2.5t won shares of 3t won current buyback

- Intense entry-level competition

- Will add to 98”+ lineup

- NAND Bit growth up mid-teens in 2Q

- DRAM Bit growth up low 10%

- NAND for PC & Mobile price decreases to end – flat going forward

- Differentiated AI for each foldable type

RSS Feed

RSS Feed